Covered California Income Chart 2018

Pursuant to title 45 code of federal regulations 155 205 covered california the exchange provides the following financial information.

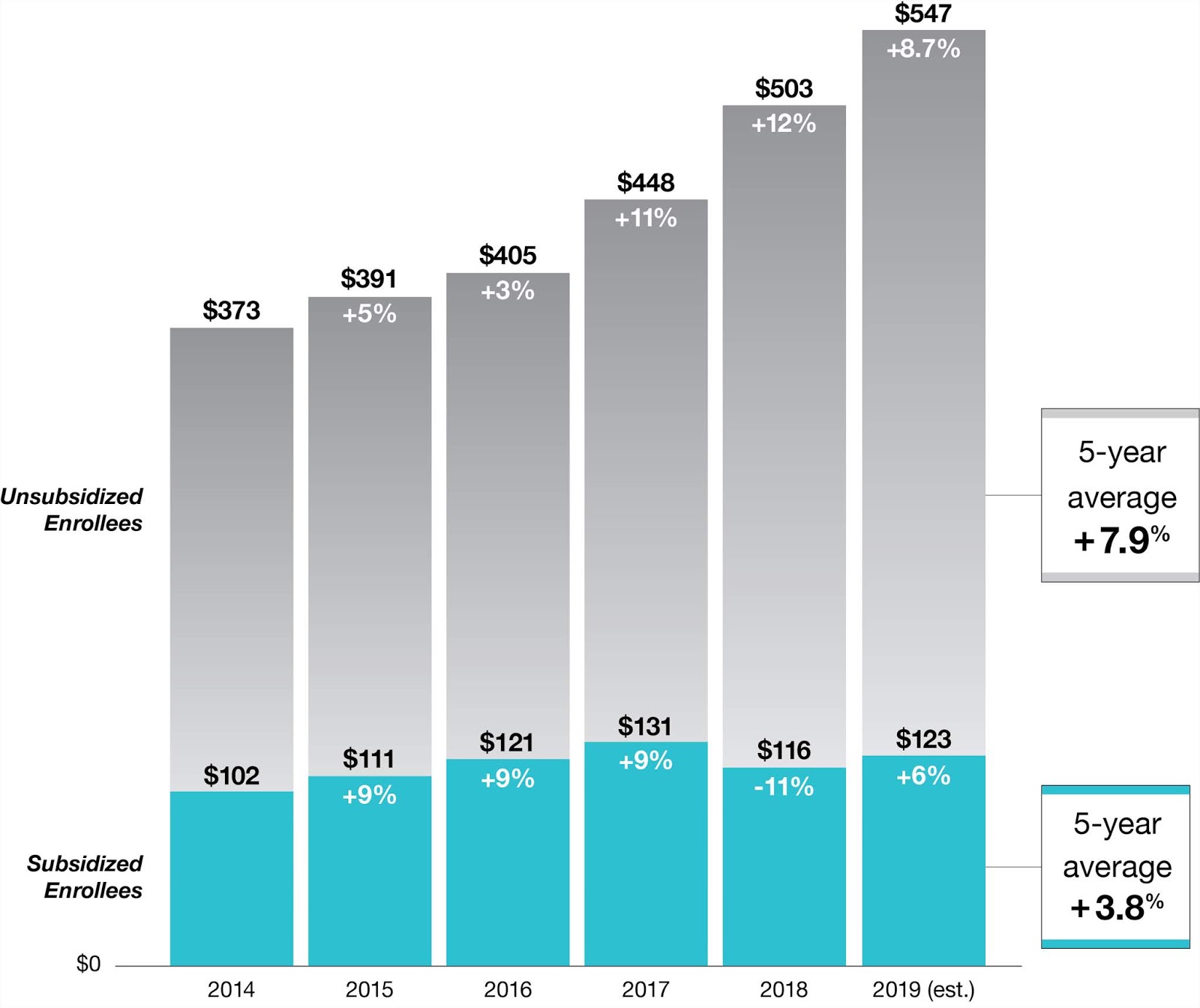

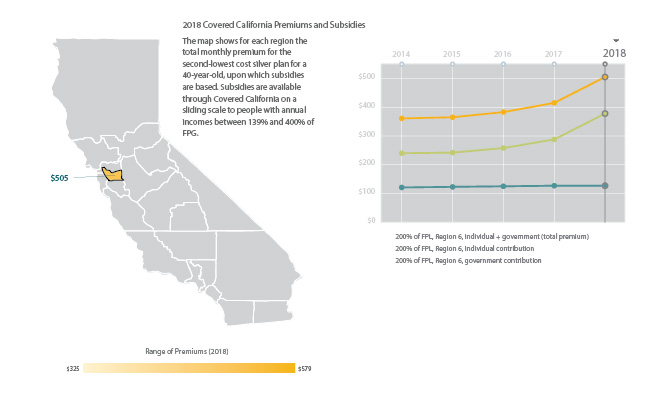

Covered california income chart 2018. 31 2018 alimony received is not counted as taxable income. The average costs of licensing and regulatory fees required by the exchange are included in the monthly participation fees paid by the qualified health and dental plan issuers contractor. The chart applies the global weighted covered california average increase of 8 7 percent to produce the estimated average unsubsidized premium which is an estimate of what off exchange enrollees may pay in 2019 the actual 2019 amount will depend on enrollee take up and plan choice during renewal and open enrollment.

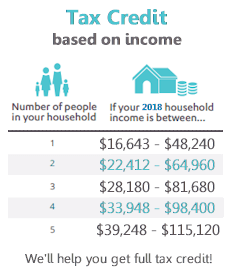

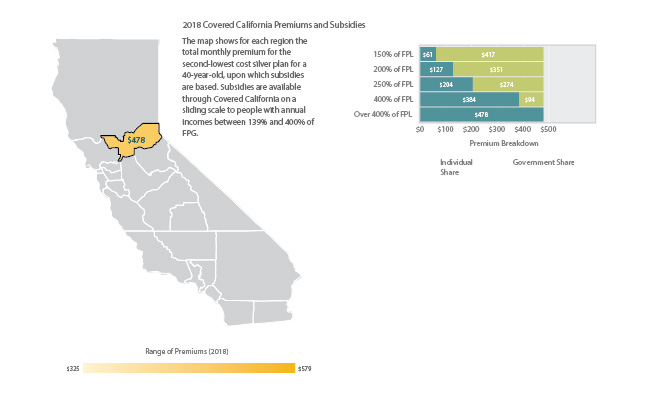

Nearly 90 of covered california enrollees 1 1 million people receive a premium subsidy. Prizes settlements and awards including alimony received and court ordered awards letters. For divorce or separation documents dated after dec.

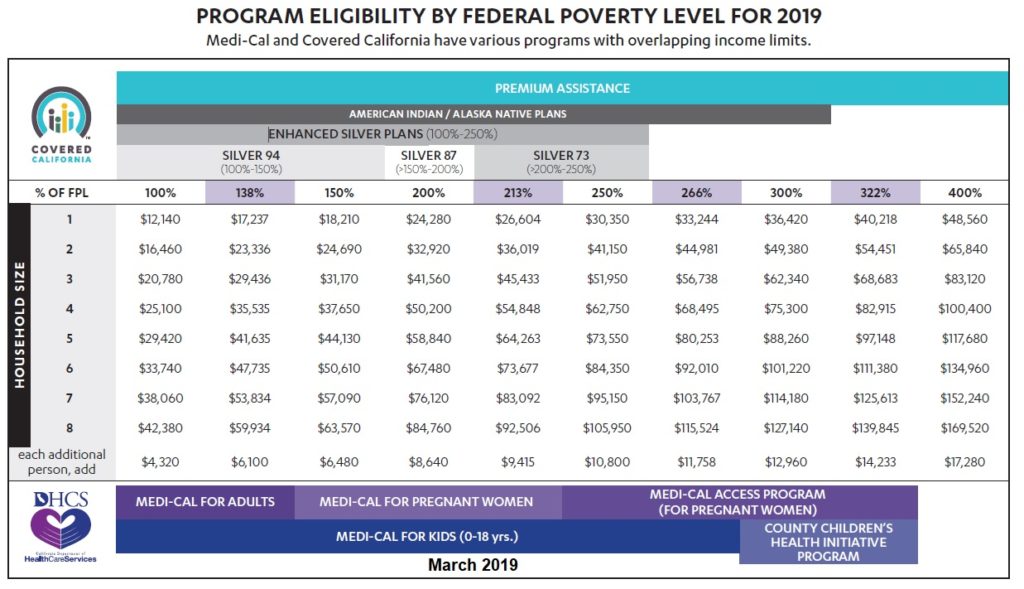

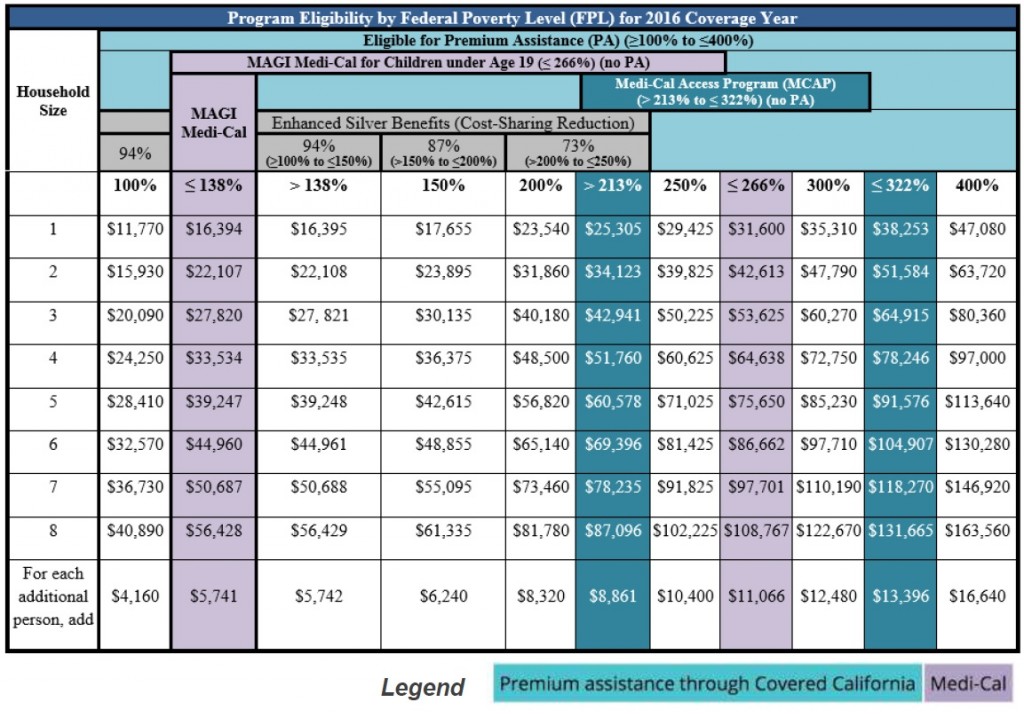

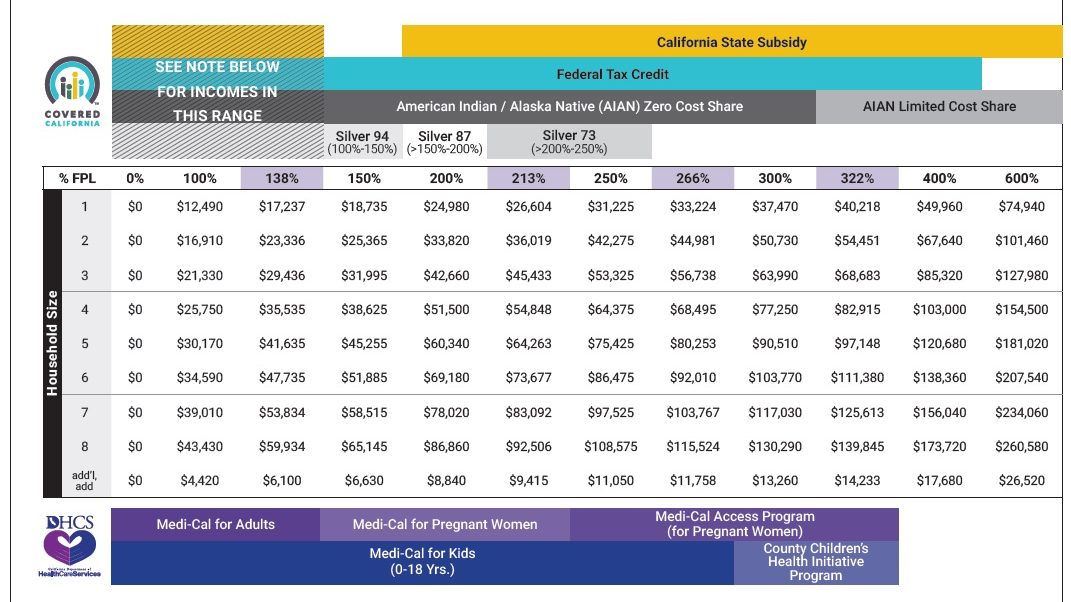

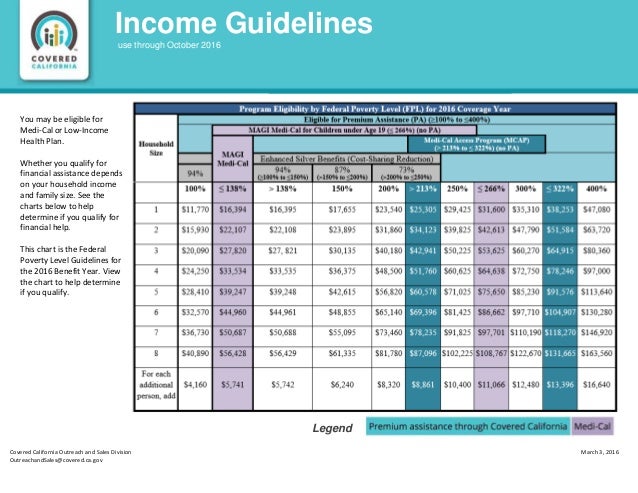

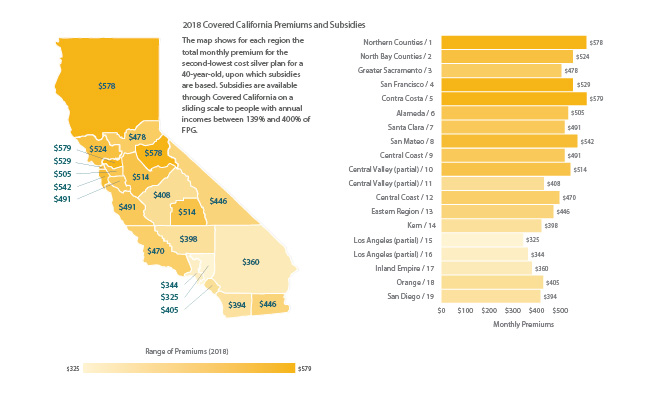

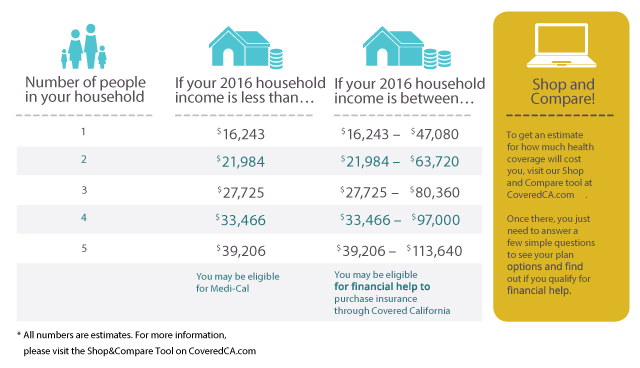

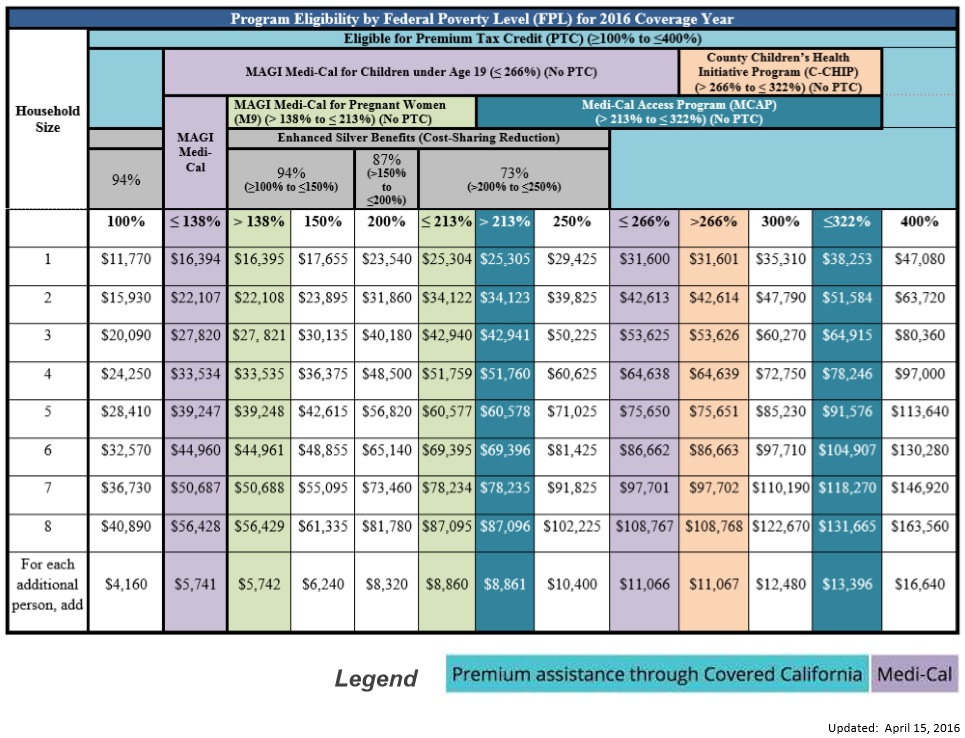

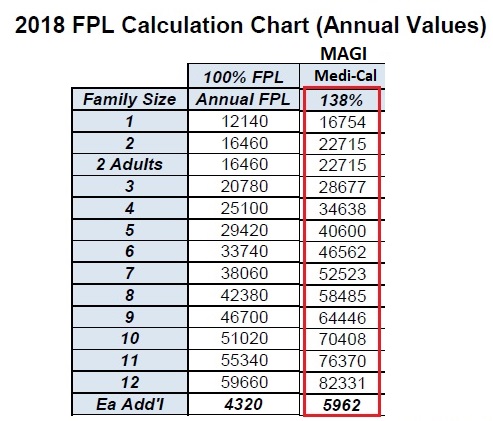

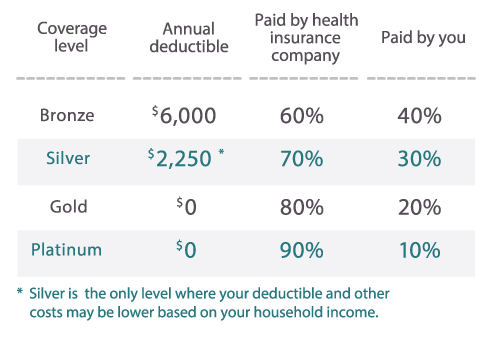

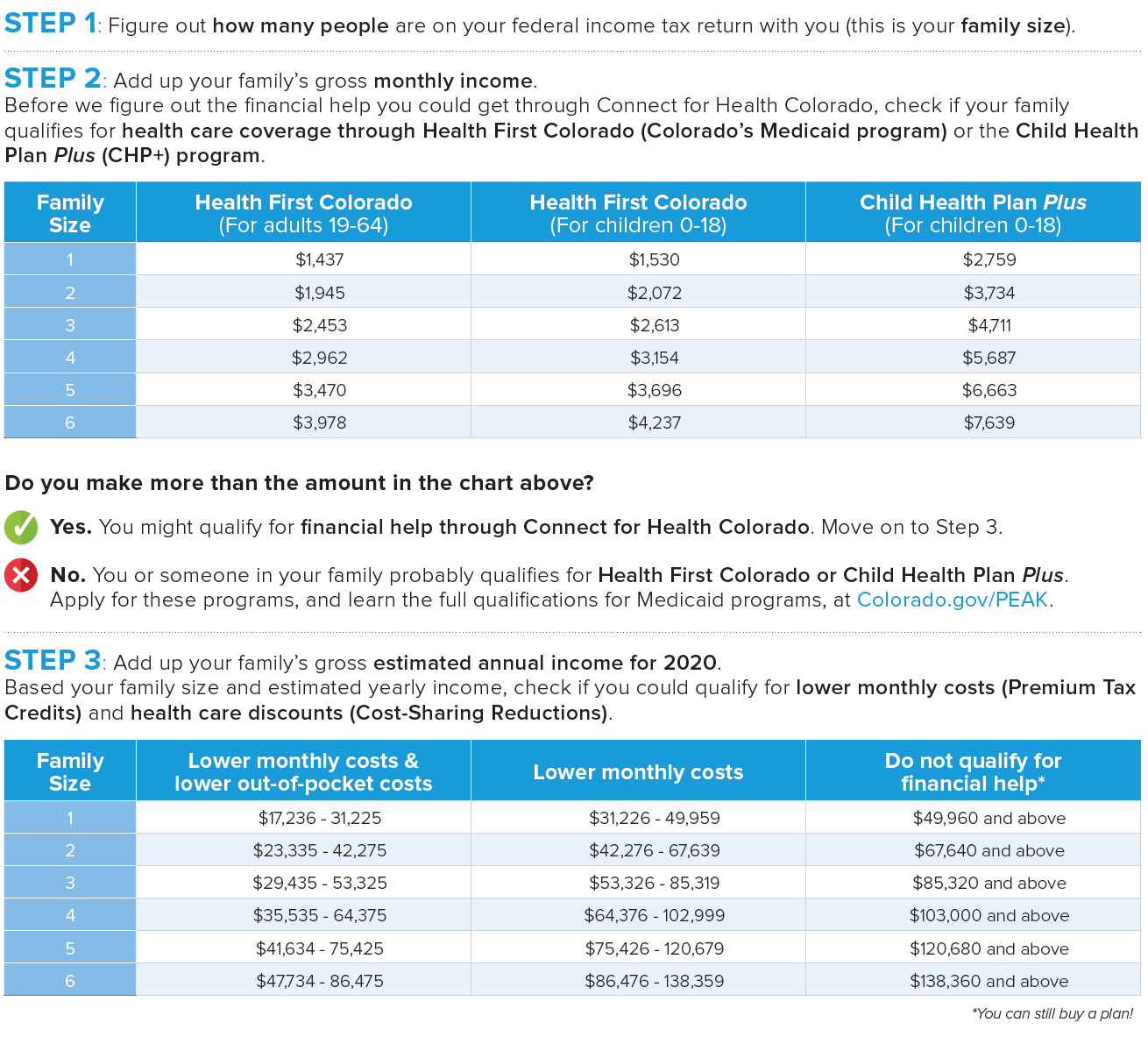

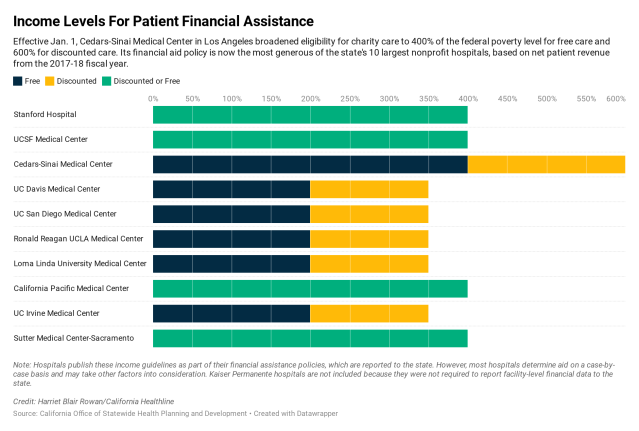

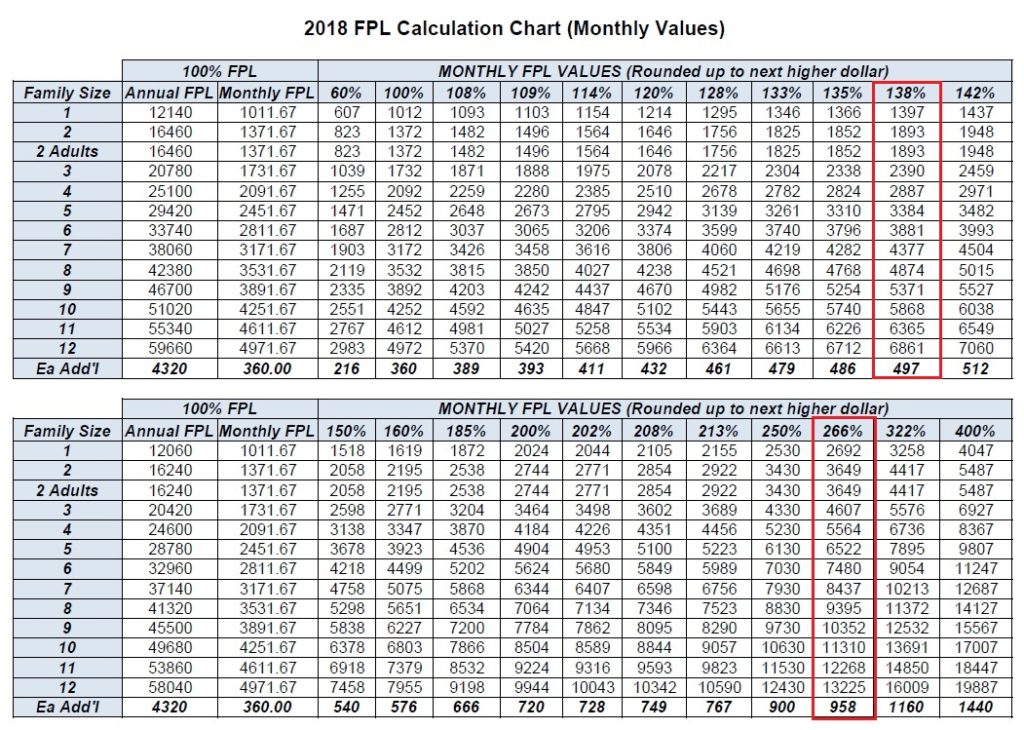

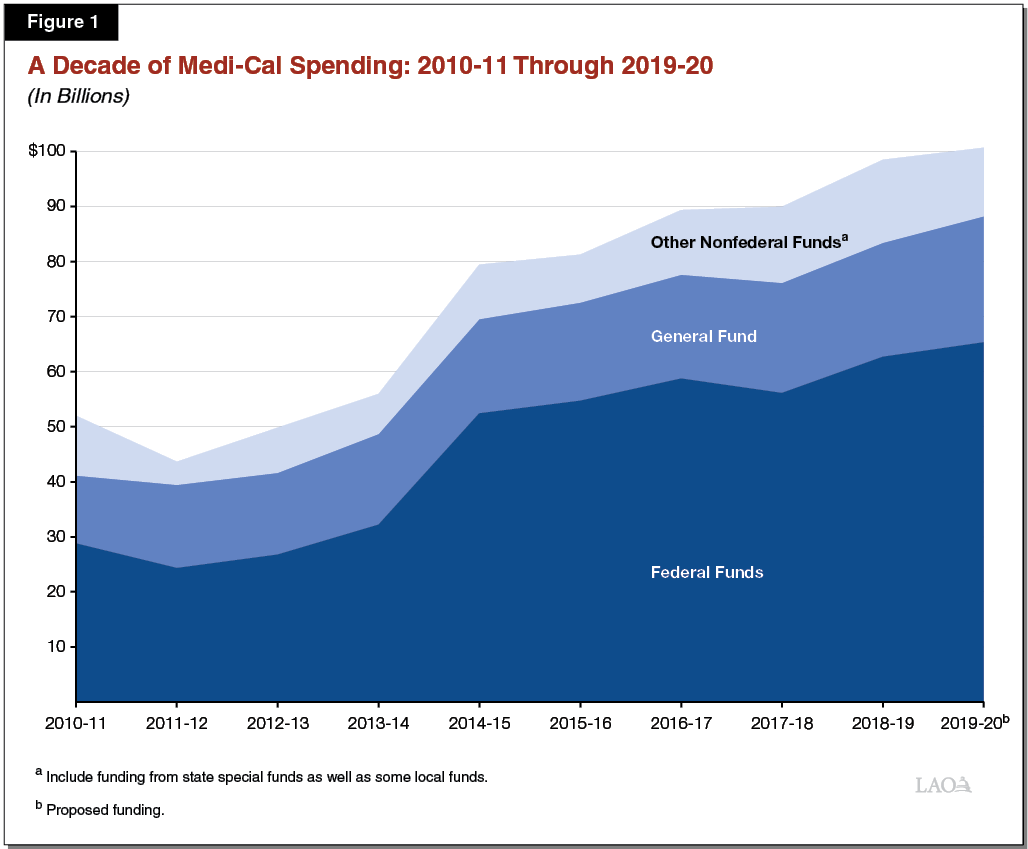

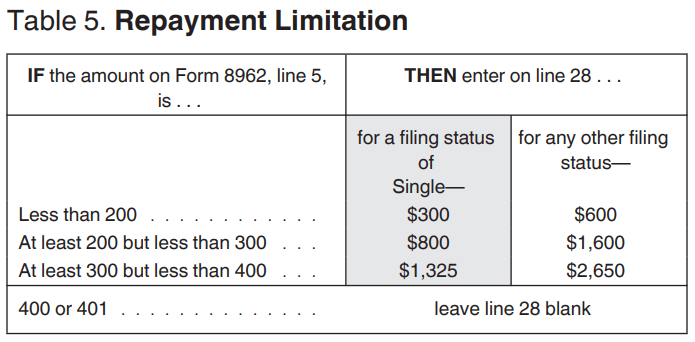

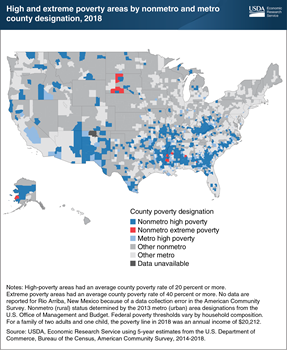

These subsidies will be available in 2018 on a sliding scale to consumers who earn between 139 and 400 of the federal poverty level fpl or 16 643 to 48 240 for an individual and 33 948 to 98 400 for a family of four. According to covered california income guidelines and salary restrictions if an individual makes less than 47 520 per year or if a family of four earns wages less than 97 200 per year then they qualify for government assistance based on their income. California state subsidy medi cal access program for pregnant women county children s health initiative program medi cal for adults medi cal for pregnant women medi cal for kids 0 18 yrs household size program eligibility by federal poverty level for 2020 medi cal and covered california have various programs with overlapping income limits.